PayNet Systems, a global payment platform headquartered in India, seeks a skilled Java developer to assist in product maintenance. Interested candidates, please reach out.

Required skills

Responsibilities

-

Experience in Java 2 years

-

Experience in RESTful APIs

-

MySQL and MongoDB

-

Spring & Hibernate frames

-

AWS

-

Develop and maintain Java apps with Spring & Hibernate frames.

-

Design, implement, and maintain databases using MySQL and MongoDB.

-

Develop and maintain REST APIs

-

Deploy and manage applications on AWS cloud services

-

Collaborate with other team members and stakeholders to ensure project success.

Java Developer

Features of Loan Management System

Fully Customizable Loan Programs

Empowering them to tailor their offerings according to the unique needs and preferences of their customers.

Real-Time Decision Making

Reduces processing times and increases efficiency, which improves the entire customer experience.

Ready-Made Connector for Other Banking Systems

Efficiency speeds up deployment and offers an easy transition for institutions using the latest technology.

Merchant Management Platform

A merchant management system simplifies and consolidates critical functions to manage merchants of all sizes and types efficiently

With a single Merchant KYC & onboarding process, multi-channel merchants can be on-boarded quickly. An easy-to-use interface enables acquirers to digitally onboard merchants, reducing onboarding time

Merchant Onboarding

Clearing and settlements are supported with multiple interchanges, including VISA, Mastercard, Rupay, Diners, JCB, UnionPay International, and American Express.

Interchange

Management

Businesses can quickly establish tiers for elaborate merchant hub systems & classify merchant relations based on location, business model, merchants type, or the organisation form.

Merchant Gateway

Enable contactless payment by scanning a QR Code from the mobile.

USSD channel facilitates mobile banking platform transactions even with a basic phone

Digital Onboarding of new customers through AI-based eKYC

Highly secure - a facility for Biometric authentication with Fingerprint and Touch ID.

Digital Payments

Users of banking mobile apps can send money to friends, family, or peers. It meets a financial need or helps in debt repayment.

Biometric Authentication

Mobile banking apps allow the use of new biometric tools, like fingerprint, facial, and eye scans for easy and fast verification.

Instant Loan Approval

Using AI and machine learning to assess client data, credit ratings, or finances can be sped up with in-app loans or permission approvals.

Mobile Wallet Integration

Users allow contactless payments, save a digital copy of their bank and debit cards, and track their funds in the banking app.

Cardless ATM Withdrawals

Users can use their mobile banking app to withdraw cash from ATMs without the requirement for physical debit cards.

Instant Transaction Notifications

Real-time transaction notifications provide users with timely updates on the status of their accounts

Expense Categorization Insights

Users can see insights based on transaction data. It helps users to review their buying habits and find areas they can reduce or go down.

Customizable Alerts Reminders

Send reminders and alerts to help clients on top of their budgets. Give notifications, task tracking, low-funds alerts, or bill payments.

Multi Language

Communicate to your users in their native language.

Omni Channel

Notify and engage your users on the channel they use, target messengers, email, SMS, push, In-App.

Targeted Campaigns

Schedule campaigns to user segments for a higher success rate in user onboarding and pending payments

Bulk & RecurringPayments

Uploading a simple.csv or.xlsx file to build payment links in bulk, also helps save time and prevent errors.

Ready Made Connectors

Ready-made connectors for leading CRM, CBS, BPM, and ESB systems, and custom integrations are available on request.

Invoicing and Reconcilation

Invoice your customers, give payment links, and get real-time reports to help the finance team better manage the books.

Why PayNet

Paynet Merchant Hub, an integrated control tool, reduces operations, saves costs, & lets acquirers manage critical business tasks.

Optimises Back-Office Efficiency

Paynet Merchant Hub improves merchant service by reducing the start-up process, offering acceptance of payments ways, & promoting business growth.

Improving Merchant Loyalty

Paynet Merchant Hub enables you to quickly and easily offer consumers their preferred payment methods.

Increased revenue by expanding base.

The system effectively becomes a global solution, lowering acquirers' total cost of ownership.

Reduces the Total Cost of Ownership

Instant Loan Approval

Using AI and machine learning to assess client data, credit ratings, or finances can be sped up with in-app loans or permission approvals.

Mobile Wallet Integration

Users allow contactless payments, save a digital copy of their bank and debit cards, and track their funds in the banking app.

Instant Transaction Notifications

Real-time transaction notifications provide users with timely updates on the status of their accounts.

Customizable Alerts Reminders

Send reminders and alerts to help clients on top of their budgets. It may have notifications, task tracking, low-funds alerts, or bill payments.

Instant Loan Approval

Using AI and machine learning to assess client data, credit ratings, or finances can be sped up with in-app loans or permission approvals.

Mobile Wallet Integration

Users allow contactless payments, save a digital copy of their bank and debit cards, and track their funds in the banking app.

Instant Transaction Notifications

Real-time transaction notifications provide users with timely updates on the status of their accounts

Customizable Alerts Reminders

Send reminders and alerts to help clients on top of their budgets. It may have notifications, task tracking, low-funds alerts, or bill payments.

Digital Payments

Users of banking mobile apps can send money to friends, family, or peers. It meets a financial need or helps in debt repayment.

Biometric Authentication

Mobile banking apps allow the use of new biometric tools, like fingerprint, facial, and eye scans for easy and fast verification.

Cardless ATM Withdrawals

Users can use their mobile banking app to withdraw cash from ATMs without the requirement for physical debit cards.

Expense Categorization Insights

Users can see insights based on transaction data. It helps users to review their buying habits and find areas they can reduce or go down.

Multi Language

Communicate to your users in their native language.

Omni Channel

Notify and engage your users on the channel they use, target messengers, email, SMS, push, In-App.

Targeted Campaigns

Schedule campaigns to user segments for a higher success rate in user onboarding and pending payments

Bulk & RecurringPayments

Uploading a simple.csv or.xlsx file to build payment links in bulk, also helps save time and prevent errors.

Ready Made Connectors

Ready-made connectors for leading CRM, CBS, BPM, and ESB systems, and custom integrations are available on request.

Invoicing and Reconcilation

Invoice your customers, give payment links, and get real-time reports to help the finance team better manage the books.

Digital Payments

Users of banking mobile apps can send money to friends, family, or peers. It meets a financial need or helps in debt repayment.

Biometric Authentication

Mobile banking apps allow the use of new biometric tools, like fingerprint, facial, and eye scans for easy and fast verification.

Instant Loan Approval

Using AI and machine learning to assess client data, credit ratings, or finances can be sped up with in-app loans or permission approvals.

Mobile Wallet Integration

Users allow contactless payments, save a digital copy of their bank and debit cards, and track their funds in the banking app.

Cardless ATM Withdrawals

Users can use their mobile banking app to withdraw cash from ATMs without the requirement for physical debit cards.

Expense Categorization Insights

Users can see insights based on transaction data. It helps users to review their buying habits and find areas they can reduce or go down.

Instant Transaction Notifications

Real-time transaction notifications provide users with timely updates on the status of their accounts

Customizable Alerts Reminders

Send reminders and alerts to help clients on top of their budgets. It may have notifications, task tracking, low-funds alerts, or bill payments.

Cardless ATM Withdrawals

Users can use their mobile banking app for ATM withdrawals without the need for real debit cards. Along with using a real card, the app creates a special code that the user puts in the ATM to finish the payment.

Instant Transaction Notifications

Users get quick updates on the status of their accounts through real-time transaction notifications. It improves security by warning users of any unauthorized payments & enables users to take immediate steps.

Expense Categorization Insights

Using transaction data, mobile banking apps may detect users' expenses and give relevant insights and reports. Users can use it to examine their spending habits and find areas wherein they may make save or cutbacks.

Customizable Alerts Reminders

To help users stay on top of their financial obligations, mobile banking apps offer modular alerts and notices. It may include alerts, goal tracking, alerts of low funds, or bill due dates.

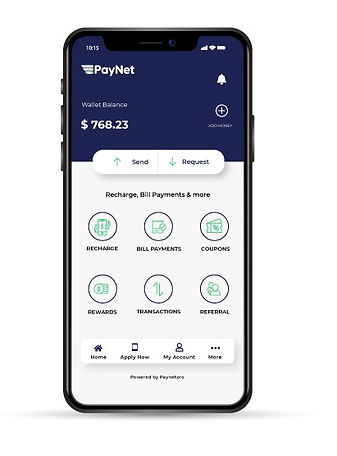

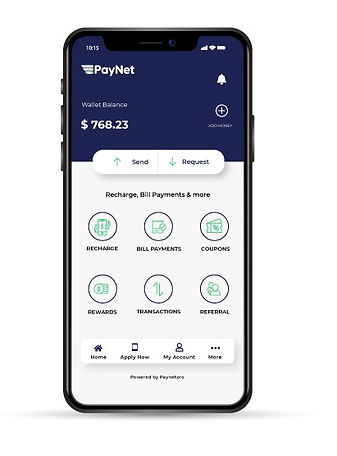

Digital Wallet is developed for Enterprise Banking and Payments Platforms, offering your digital growth.

The implementation is fast to go to market, flexible, and gives fast positive ROI. Cloud, on-premises, or both of the two.

Over 7+ years of global experience with 10 Mn users in over 11 countries.

Offering a wide variety of financial services and payments at all times and from any location. Begin with the Digital Wallet.

28% of clients are inclined to go to the business as they're part of a loyalty program.

By retaining just 5% of their customer base, businesses can raise sales by up to 75%.

32.3% of clients, have increased their interest in merchant rewards programs.

All-in-one digital wallet solution

10x Faster Time-to-Market

Deploy your wallet software in your own systems for a quick start. No need to set it up from scratch, it reduces time and cost.

Highly Scalable

If you run ten, thousand, or 10 million payments per day, our e-wallet provider, can keep up your rapid growth, letting you stay focused on it.

Easy To start

Our digital wallet platform is cloud-based and available on a subscription basis. If you need on-premise software, however.

Streamlined Integrations

Add new features e-wallet solution via our standard API. Integrate with all open systems to speed up your client's needs and stand out among rivals.

User Case Study

KPay Digital Wallet

Quickpay is a Fintech focused on financial inclusion in Senegal and Africa. Its vocation is to help all segments of the population to easily access financial services.

Quickpay is a 100% Senegalese entity with agile management that produces quality in its services. KPay Wallet is a mobile payment platform that aims to revolutionize financial transactions in Kenya.

.

The digital wallet provides users with a convenient and secure method for making payments, transferring money, and managing their finances through their smartphones.

KPay Wallet envisions becoming the go-to mobile payment solution in Kenya, offering a seamless and inclusive financial experience to users across the country.

100000+

App downloads

Use cases for small-medium-sized businesses

Using online stored-value offerings, you reach the demographic you want and your audience. Here are a couple of examples of how it can be used to generate new revenue streams for well-established businesses.

Merchants for eCommerce and retail

Connect merchants and buyers by facilitating peer-to-peer transfers in several currencies. The competitive nature of these marketplaces often leads to innovations in payment systems, and customer service, enhancing the overall customer experience.

Banks

Maintain your competitive advantage and generate more revenue by offering digital wallet services to your consumers on the go 24 hours a day, seven days a week.

Loyalty Program

Create a rewards program based on a closed-wallet system. You can offer prepaid, gift, bonus cards, rewards, and refund processes while keeping a record of each transaction and updating balances in real-time to provide extra value to your consumers.

Gaming Industry

Tech companies are in the business of innovation and financial services. Closed-loop wallets align perfectly with their goals by transforming how users manage and transfer money.

User Case Study

NMB Omnichannel Banking

NMB Bank, one of Nepal's leading financial institutions, recognized the need to adapt to changing customer expectations and evolving technology trends in the banking industry.

NMB Bank Limited licensed as “A” class financial institution by Nepal Rastra Bank in May 2008 has been operating in the Nepalese Financial market for over twenty years and is one of the leading commercial banks in the banking industry.

The Bank has a Joint Venture Agreement with Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden (FMO), wherein FMO holds 13.69% of the Bank’s shares and is the largest shareholder of the Bank.

In September 2016, the Bank signed a Joint Venture Agreement with Nederlandse.

500000+

App downloads

Use Cases

28% of customers are extremely inclined to visit businesses where they are a member of a loyalty program to do so.

By retaining just 5% of their customer base, businesses can raise sales by up to 75%.

According to 32.3% of consumers, the recession has increased their involvement in retailer rewards programs.

User Case Study

United Points Loyalty Reward Program

United Points is founded on the mission to solve a common problem in the loyalty and rewards industry. Today, there is a great disconnection and complexity between businesses, merchants, and consumers, resulting in businesses declining in revenue.

United Points’ unique strength lies in our proven shared experience and capabilities as the matchmaker to connect and greatly simplify and shorten engagements between businesses, merchants, and consumers, through a seamless global loyalty and rewards platform.

United Points, a leading loyalty program provider, aimed to enhance its offering by introducing a closed-loop wallet solution. The objective was to provide a seamless, secure, and highly flexible digital wallet system to its customers, enabling them to earn, manage, and redeem points easily across a variety of partners.

Why Choose PayNet Systems?

Digital Wallet is developed for Enterprise Banking and Payments Platforms, offering your digital growth.

The implementation is fast to go to market, flexible, and gives fast positive ROI. Cloud, on-premises, or both of the two.

Over 7+ years of global experience with 10 Mn users in over 11 countries.

Offering a wide variety of financial services and payments at all times and from any location. Begin with the Digital Wallet.

Fully Customizable Workflows

Create workflows with specific business rules for each of your clients. Create price schemes with distinct charges and caps for each kind of operation. Find a balance between providing the most value to clients and making a profit for your company.

Advance Analytics and Dashboards

Our comprehensive visual dashboard offers quick, real-time insight into your company's performance. Increase the revenue from your products by analyzing your consumers' behavior and gaining valuable insights into monetization opportunities.

Built-in Connectors

The Paynet digital wallet platform provides a fast cut in product implementation with built-in connectors for all significant core banking suppliers. This allows you to launch your business banking product quickly and with less expense.

Omni Channel Onboarding

Paynet is a digital wallet software platform.

We enable organizations to accelerate the Omni Channel customer onboarding journey by automating and optimizing the process using an automated process.

.jpg)

.jpg)

ROLE: SALES INTERNSHIP

Qualification:

Graduate in any field.

Skills:

Communication Skills, Interpersonal Skills, Problem-Solving, Sales Management,

Teamwork.

Location:

Remote

Shift Timings:

Flexible

Key Responsibilities:

-

Spread the word about our game-changing products.

-

Turn potential clients into lifelong partners.

-

Bring your ideas to the table – we love fresh perspectives!

ROLE: SOFTWARE DEVELOPER JOBS

Qualification:

Bachelor's degree in Computer Science or a related field.

Experience:

2 Years of software development experience preferably in the Fintech industry

Skills:

Java, Spring & Hibernate, MySQL, AWS, Mongo, and REST API

Key Responsibilities:

-

Develop and maintain Java apps with Spring & Hibernate frames.

-

Design, implement, and maintain databases using MySQL and MongoDB.

-

Develop and maintain REST APIs

-

Deploy and manage applications on AWS cloud services

-

Collaborate with other team members and stakeholders to ensure project success.